Start with Understanding. Invest with Confidence.

Commercial property isn't just a bigger investment — it's a different way of thinking.

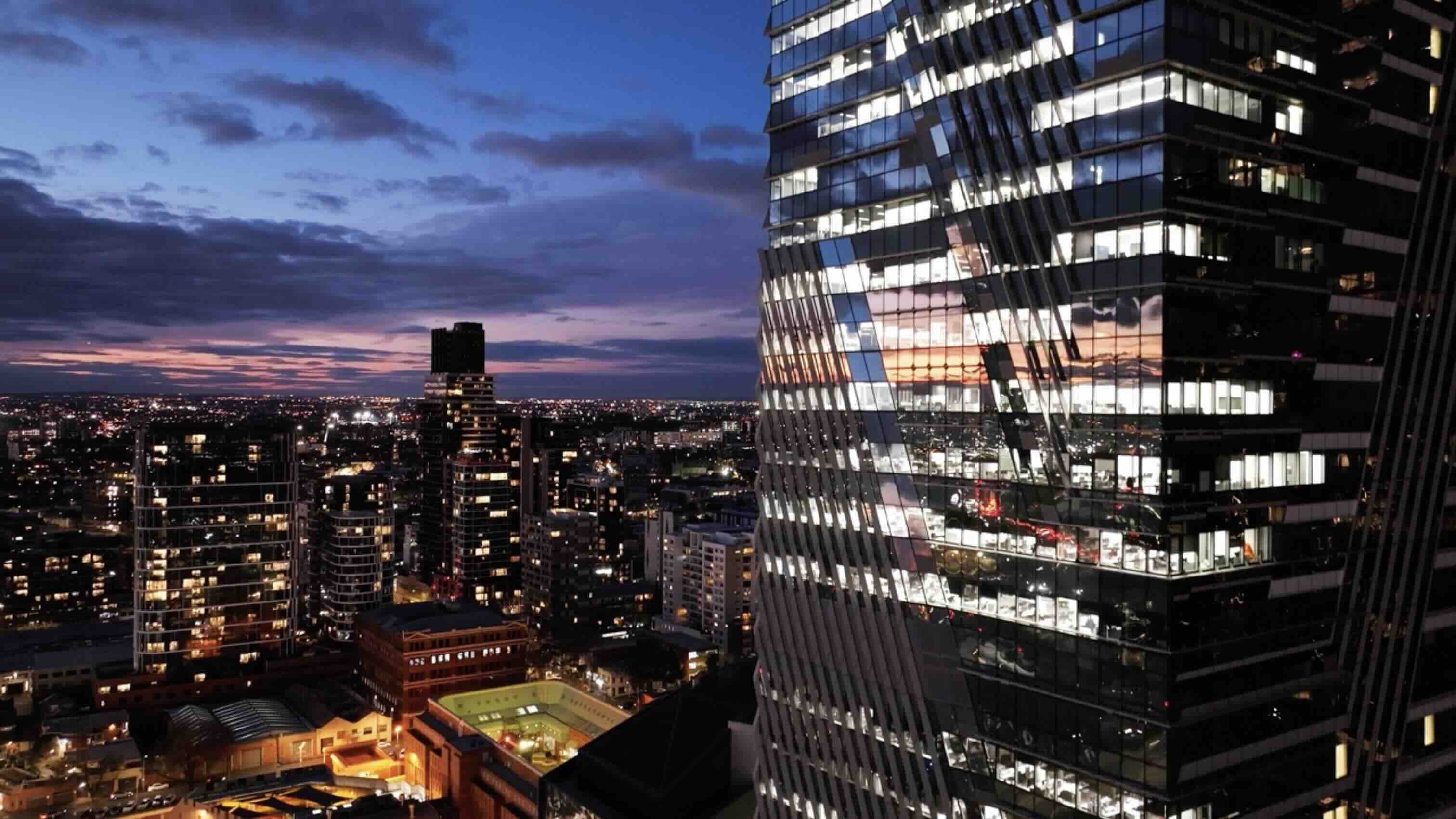

We focus on high-quality Australian commercial assets designed to strengthen cash flow and long-term value.

Why Choose Commercial Property

Unlike residential property, commercial assets are built on contracts, not emotions.

Lease Strength

Longer leases with clearer terms support income visibility across market cycles.

Income Clarity

Net leases help separate operating costs from income, improving predictability.

Professional Tenants

Established brands and essential services reduce volatility in occupancy and trade.

*Yield targets are indicative only and not guaranteed.

Commercial Properties

The following are representative examples of the types of assets we target. Each asset is assessed on fundamentals: tenant strength, lease profile, location supply–demand, and value-add potential.

Warehouse Investment

Purchase Price

$1,325,000

Yield

6.4%

Investment Logic

A stable industrial asset located in Victoria, offering consistent rental returns and long-term tenant security.

Essential Services Tenant

Purchase Price

$400,000

Yield

7.0%

Investment Logic

A Queensland essential-services property with strong tenant demand and dependable cashflow.

Service Station

Purchase Price

$5,780,000

Yield

6.25%

Income

$360,900 + GST (NET)

Investment Logic

A high-performing service station asset delivering stable long-term net income with strong fundamentals.

Childcare Centre

Purchase Price

$3,720,000

Yield

6.45%

Income

$239,880 + GST (NET)

Investment Logic

A South Australia childcare investment with strong operator demand and reliable net rental income.

Medical Centre

Purchase Price

$800,000

Yield

6.0%

Income

$48,000

Investment Logic

A medical-use property in Queensland, backed by stable healthcare-sector performance.

Centrelink (Off-Market)

Purchase Price

$10,000,000

Income

Rental Income

Income

Rental income

Investment Logic

A confidential off-market acquisition leased to Centrelink, located in metropolitan city centre.

*Examples shown are illustrative only. Past performance and examples do not guarantee future outcomes.

From Exploration to Execution

Our proven framework guides you through each stage of commercial property investment, ensuring clarity and confidence at every step.

CLARIFY OBJECTIVES

- Define yield vs. capital growth priorities

- Assess investment capacity and timeline

- Establish risk parameters

ARCHITECT STRATEGY

- Select investment vehicle and structure

- Determine financing approach

- Plan for tax optimisation

SOURCE ASSET

- Screen opportunities against mandate criteria

- Analyse cash flow and tenant quality

- Assess market positioning

EXECUTE & STEWARD

- Negotiate terms and complete due diligence

- Execute the transaction and settlement

- Monitor performance and optimise operations

CLARIFY OBJECTIVES

- Define yield vs. capital growth priorities

- Assess investment capacity and timeline

- Establish risk parameters

ARCHITECT STRATEGY

- Select investment vehicle and structure

- Determine financing approach

- Plan for tax optimisation

SOURCE ASSET

- Screen opportunities against mandate criteria

- Analyse cash flow and tenant quality

- Assess market positioning

EXECUTE & STEWARD

- Negotiate terms and complete due diligence

- Execute the transaction and settlement

- Monitor performance and optimise operations

Every investment journey is unique. Our framework adapts to your specific needs while maintaining the discipline that drives successful outcomes.

Frequently Asked Questions

What's the minimum investment?

We tailor structures to the opportunity. We'll discuss minimums during your consultation.

How long is the typical hold period?

Commonly 3–7 years, depending on the asset's lease profile and value-add timeline.

Do you provide ongoing reporting?

Yes—periodic income statements, tenant updates, and value-add milestones.

What are the key risks?

Vacancy risk, tenant performance, interest rates, capex overruns, and market repricing. We address these through conservative underwriting and sensitivity analysis.

Is this financial advice?

No. We provide information and execution support. Always seek independent advice.